The levelized cost of energy (LCOE) is the total project lifecycle cost expressed in cents per kilowatt-hour of electricity delivered by the system over its life to the grid for front-of-meter projects, or to the grid and/or load for behind-the-meter projects.

The LCOE includes the following costs:

•The project equity investment: Equipment and labor costs, construction period financing costs, project development and financing fees, and sales tax less the size of debt (amount borrowed).

•Operating expenses, including for operation and maintenance, insurance payments, and property taxes.

•Cost of electricity purchased to meet night-time photovoltaic inverter consumption, concentrating solar power freeze protection and other parasitic loads that occur when the system is not generating power, and to charge batteries for systems with energy storage.

•Project term debt costs: Principal and interest payments, and funding of debt service reserve account.

•Funding of and disbursement reserves: Working capital, equipment replacement, and debt service

•State and federal tax liability.

Note. In the cash flow model for distributed behind-the-meter projects with battery storage, the cost of electricity to charge the battery is accounted for as a reduction in the project's energy savings. For these projects, the energy term of the LCOE equation is based on electricity delivered to the grid and/or load over the project life by the photovoltaic system or other power source and the battery. In order to correctly account for the cost of charging the battery, the LCOE equation includes an estimate of this cost based on the retail electricity rate structure (which may include tiered and/or time-of-use rates), even though this cost is not treated as a cost to the project in the cash flow.

The levelized cost includes the following benefits:

•State and federal tax benefits: Depreciation, tax credits, deductible expenses, deductible debt interest payments.

•Interest earned on reserve accounts.

•Cash incentives: Investment-based, capacity-based, and production-based incentives.

•Salvage value

The levelized cost in SAM depends on the following assumptions:

•The quantity of electricity generated by the system for each year in the analysis period, shown as Energy in the cash flow table. The performance model calculates the annual energy in Year 1 based on the hourly simulations. SAM adjusts this value by the factors that you specify on the Degradation page.

•Installation and operating costs on the Installation Costs and Operating Costs pages

•Financial assumptions on the Financial Parameters page

•Incentives on the Incentives page

•Depreciation assumptions on the Depreciation page

Note. For distributed behind-the-meter projects without storage, the retail electricity prices from the Electricity Rates page do not affect the LCOE. The LCOE is a measure of the cost of installing and operating the system, not of the value of electricity purchases avoided by the system. The project NPV is a measure of both the project costs and energy value.

To use the LCOE for evaluating project options, it must be comparable to cost per energy values for alternative options:

•For distributed behind-the-meter projects (Residential, Commercial, Third Party Ownership), SAM assumes that the renewable energy system meets all or part of a building's electric load, so the LCOE is comparable to a $/kWh retail electricity rate representing cost of the alternative option to meet all the building's load by purchasing electricity from the grid at retail rates. To be economically viable, the project's LCOE must be equal to or less than the average retail electric rate.

•For front-of-meter projects (PPA, Merchant Plant, Community Solar), SAM assumes that the project sells all of the electricity generated by the system at a price negotiated through a power purchase agreement (PPA), or at hourly or subhourly market prices. For PPA projects, the LCOE is comparable to the levelized PPA price: A financially viable project is likely to have a LCOE that is equal to or less than the levelized PPA price to cover project costs and meet internal rate of return requirements.

The LCOE should be considered with the other financial metrics to evaluate a project's financial feasibility. For example, a financially feasible project is likely to have a positive net present value (NPV) given the discount rate you assume, reasonable capacity factor, and depending on the financial model, a reasonable payback period, internal rate of return, size of debt, etc.

Real and Nominal Levelized Cost of Energy

For all financial models, SAM calculates both a real and nominal LCOE values. The real LCOE is a constant dollar, inflation-adjusted value. The nominal LCOE is a current dollar value.

The choice of real or nominal LCOE depends on the analysis. Real (constant) dollars may be appropriate for long-term analyses to account for many years of inflation over the project life, while nominal (current) dollars may be more appropriate for short-term analyses.

Some industries prefer to use one form over the other. For example, when discussing LCOE for parabolic trough projects, analysts have tended to use the nominal LCOE (see Current and Future Costs for Parabolic Trough and Power Tower Systems in the US Market), while the U.S. Department of Energy has used the real LCOE in its comparative analysis of photovoltaic project costs (Solar Energy Technologies Program Multi-Year Program Plan 2007-2011).

Be sure to use the same form of the LCOE when comparing costs for different alternatives: Never compare a real LCOE of one alternative with a nominal LCOE of another.

Levelized Cost of Energy Equations

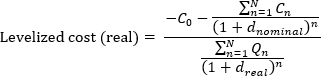

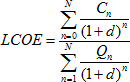

For the real LCOE, the real discount rate appears in the denominator's total energy output term:

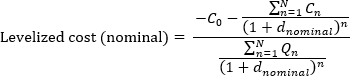

Similarly, for the nominal LCOE, the nominal discount rate appears in the denominator's total energy output term:

Where,

Qn (kWh) |

Electricity delivered by the system to the grid (and/or load if applicable) in year n. |

N |

Analysis period in years as defined on the Financial Parameters page |

C0 |

The project's equity investment amount. |

Cn |

The annual project costs in Year n, as listed under costs and benefits above. |

dreal |

The real discount rate defined on the Financial Parameters page. This is the discount rate without inflation. See LCOE Definition for an explanation of discount rates in the LCOE calculation. |

dnominal |

The nominal discount rate shown on the Financial Parameters page. This is the discount rate with inflation. |

Levelized Cost of Energy Definition

This description of the LCOE of energy uses the vocabulary and equations described in the Manual for the Economic Evaluation of Energy Efficiency and Renewable Energy Technologies. (Short 1995) http://www.nrel.gov/docs/legosti/old/5173.pdf.

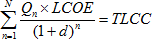

By definition, a project's annual cost Cn is the product of the LCOE and the quantity of electricity delivered by the system to the grid and/or load in that year, Qn:

Cn = Qn × LCOE

Project costs Cn include installation, operation and maintenance, financial costs and fees, and tax benefit or liability, and also account for incentives and salvage value. SAM's performance model calculates the annual energy Qn for n = 1. For n > 1, Qn decreases from year to year if the degradation rate on the Degradation page is greater than zero. Otherwise, the annual energy is constant over the analysis period.

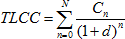

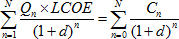

The project's total lifecycle cost (TLCC) is the present worth of project costs over the analysis period N discounted at rate d:

Substituting the cost equation for Cn:

Combining the two equations above gives:

Notes.

The annual cost Cn includes the effect of inflation, so the nominal discount rate is the correct form to use on the right side of the equation.

The correct form of the discount rate on the left side of the equation depends on whether the LCOE is a real or nominal value.

The summation in the left hand term begins at n = 1, which is the first year that the system produces energy. The right hand summation begins at n = 0 to include investment costs in the calculation.

Solving for LCOE gives:

Note. This equation makes it appear that the energy term in the denominator is discounted. That is a result of the algebraic solution of the equation, not an indication of the physical performance of the system.